Affordability Continued

Remember, in the movie Christmas Vacation, how Clark Griswold was going crazy in anticipation of his annual bonus, how he had big plans to build a pool in the backyard? I wonder how many of you do the same thing, pre-spend what you expect to get. I know I used too.

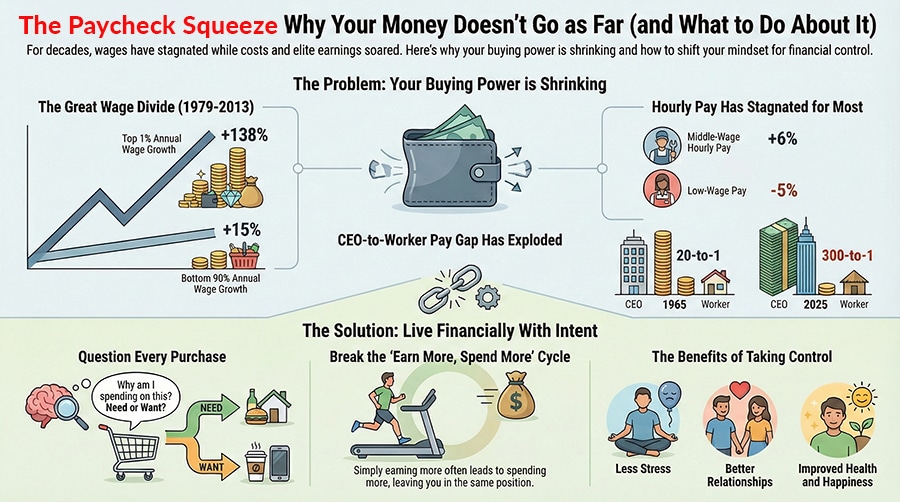

I’ve never met a person that didn’t learn to spend more after getting a raise, meaning you still are living paycheck to paycheck. But, for the middle- and lower-class folks the problem is that your increase in wages isn’t keeping up with the cost of living. For the top 1%, well, you’re doing just fine. In 1965 the CEO to worker compensation was roughly 20 times and by the year 2000 that increased to 383 times. But don’t fret as that has come down to 300 times in 2025.

Remember how I mentioned that rich people buy time while poor people buy stuff (it’s in my book). Well, the middle- and lower-class folks can’t keep buying stuff if their wages are not keeping up with inflation (cost of living). At least not without creating greater debt. It’s simple math, your buying power has been reduced unless you take on more debt.

In the last report I spoke about price gouging by the fortune 500 folks. Add to that the inflation-adjusted value of the minimum wage that has been in decline since 1968 where it peaked. And with the price of goods and services rising, you can understand why you can’t buy as much stuff as you used to.

So that’s yet another economic reason why most of us are having trouble financially these days (there are more), but what can we do about it? Right now, wages are stagnant, so how else can you find ways to live a better life? You can learn about your relationship with the money you earn and take control by learning how you spend it. What compels you to spend that leftover money you have after paying the bills? Is it on things really needed, or more on what you want?

An experience I had a few years ago was walking into a store whist I had no money to spend and everything I saw looked great, with many things I wished I could buy. Two weeks later, when I was flush with cash, I went back to that store thinking I was going to buy some of those things I really liked. As it turned out, nothing looked all that good anymore and I left without buying anything. Much like how that new car looks and smells great, but a few years later, maybe not so much. Or how about those fashionable clothes you looked so great in last year, that just doesn’t cut it this year.

What I’m saying is that you need to start asking yourself, “why am I spending money on whatever it is I’m buying?”. You need to start living financially with intent! If you take control of your spending, I promise life will start to look better, you’ll be happier, have better relationships, be healthier, and reduce stress in your life.

Okay, let’s get back to what “Affordability” means?

Affordability is defined as a quality of being inexpensive. Because of the affordability of the apples at the orchard, we went ahead and bought a whole bushel. The adjective affordability describes things you can afford to pay for because they don’t cost too much.

So, when you hear repeatedly on the news and with politicians how the powers that be need to provide affordability, I’d like them to define what that means. Common sense says if items are becoming more expensive, and wages are falling behind, that would leave less items that are affordable. It seems that common sense is still evading the halls of Congress.

OUR MINDSET ON MONEY

It’s Easy to Control, So Why Don’t We?

Money controls most of us, and I’ve been wondering why we let this happen. This book dives into how we can gain control of our money and therefore enjoy more of what life really has to offer. It is not about what to do with each and every dollar we make as it is more about our relationship with it. Money affects us from birth to death and yet we’re taught that it’s taboo to talk about it. And therein lies the rub, if you aren’t supposed to discuss it then how are you ever going to learn about it and take control? In these pages you’ll learn about the many financial challenges that you will face at some point in life, and you’ll be better off knowing what to expect and how you can then choose to deal with it. In other words, how to take control.

There’s an old saying I believe in that states “If you want to understand what’s going on, then just follow the money.” Problem is, most of us can’t.

It’s not your fault, we’re not supposed to talk about it, and we’re not taught anything in school and rarely at home. As a financial advisor I learned that most spouses rarely talk about two things, money and sex. When I’m in front of groups I would say that I’m here to help you with one of those. But the reality is that if spouses aren’t talking about money, they certainly aren’t talking to their children about it.