Affordability

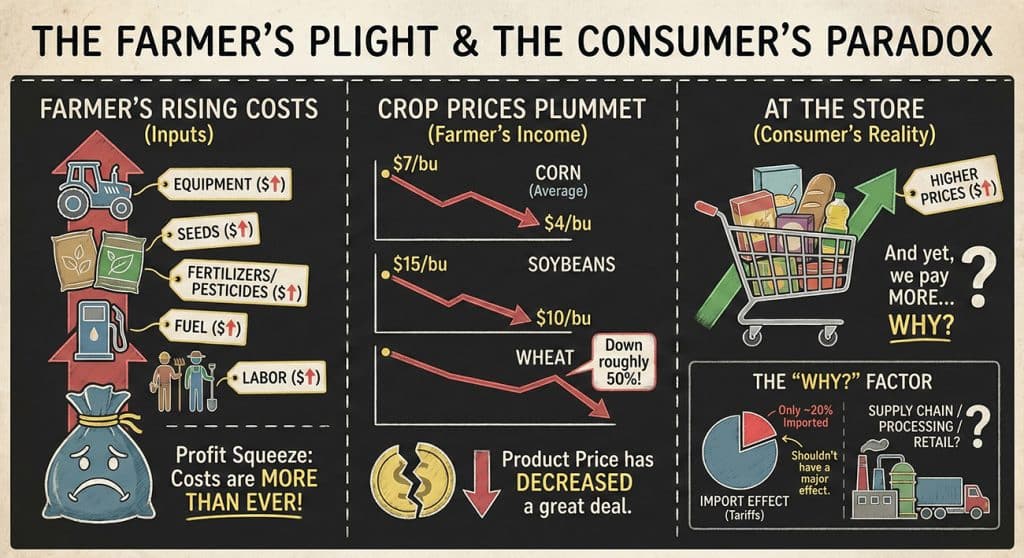

Okay, I’ll bite and say that the tariffs have had effects on pricing on some products, but let me ask you this: Why are farmers losing their farms and getting choked out financially? If prices are higher, aren’t they making more money?

Affordability

These are challenging times for farmers as labor, seeds, equipment, fertilizers, pesticides, and fuel are all costing more than ever now. And yet, the price of their product has decreased a great deal. Corn went from an average of $7/bushel down to $4/bushel, while soybeans were running at about $15/bushel dropped to $10/bushel. Wheat is down roughly 50%! And yet, we pay higher prices at the store for these products, why? Yes, tariffs have had an effect here, but let’s be clear, we import only about 20% of food so it shouldn’t have a major effect.

Labor and logistics, like trucking, energy and fuel, along with packaging and materials have all seen price increases. Let’s call these the middleman cut as the product has yet to reach the market. Experts and government report (what we already know) that retail prices often remain higher, even when wholesale prices decrease. It’s called price “stickiness”. And then there’s the old trick of the shrinking box.

You know, where we get 75% of a product for the same price we used to get 100%. A tactic called Shrinkflation, observed by 75% of consumers in 2025 thus far.

And now I can get to the real problem: Price gouging! Corporate America is extremely good at knowing how and when to raise prices. And once they are in place, they rarely ever go back down. But you don’t mind as you own all those stocks and get your money back when they rise from making record profits. Oh wait, you don’t own those stocks as 90% of all stocks are owned by 10% of the populace. Let’s try and be fair here as the fortune 500 folks have rising costs just like the farmers, so let’s try to see it from their point of view.

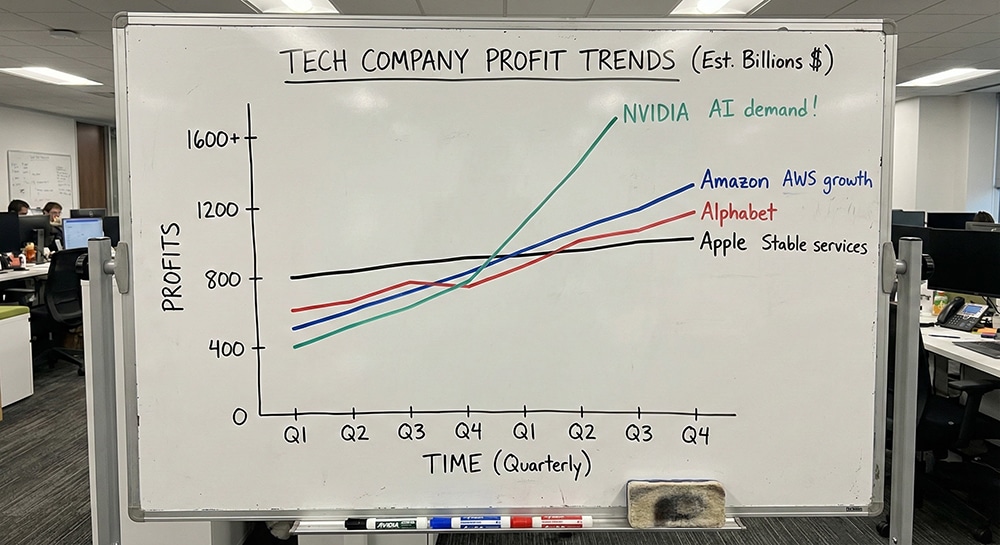

Okay, let’s just see how they’re doing and if they’re feeling the pain most of us are feeling:

The 2025 Fortune 500 list, which ranks companies by revenue for the 2024 fiscal year, revealed that American business performance was at a record high.

Total Profit Record: Collectively, all Fortune 500 companies posted a record $1.87 trillion in aggregate earnings, the most in the list’s history in dollars.

Key Companies with Record Profits: The “Magnificent Seven” U.S. tech companies (Amazon, Apple, Alphabet, Microsoft, Meta Platforms, Nvidia, and Tesla) posted a record aggregate profit of $484 billion.

- Alphabet, Apple, and Microsoft each earned over $100 billion in net income.

- NVIDIA stood out with a remarkable 53.7% profit margin due to high AI chip demand.

- Amazon was also noted as having reported record profits in 2025

Well, I guess they aren’t feeling the pinch most of us feel. You can continue to blame the Democrats or the Republicans or the tariffs, but the reality is we the people are footing the bill and corporate America is a huge beneficiary.

I’m saying, let’s put the onus on those that are really hitting us in the pocketbook. I know, it’s Christmas, and we love to give, but let’s start to rethink how we use our hard-earned money and whom we give it to. I’ve heard there’s a great book on this subject and would make for an inexpensive gift this holiday season.

Happy Holidays, and my very best wishes in the coming year to you all!

OUR MINDSET ON MONEY

It’s Easy to Control, So Why Don’t We?

Money controls most of us, and I’ve been wondering why we let this happen. This book dives into how we can gain control of our money and therefore enjoy more of what life really has to offer. It is not about what to do with each and every dollar we make as it is more about our relationship with it. Money affects us from birth to death and yet we’re taught that it’s taboo to talk about it. And therein lies the rub, if you aren’t supposed to discuss it then how are you ever going to learn about it and take control? In these pages you’ll learn about the many financial challenges that you will face at some point in life, and you’ll be better off knowing what to expect and how you can then choose to deal with it. In other words, how to take control.

There’s an old saying I believe in that states “If you want to understand what’s going on, then just follow the money.” Problem is, most of us can’t.

It’s not your fault, we’re not supposed to talk about it, and we’re not taught anything in school and rarely at home. As a financial advisor I learned that most spouses rarely talk about two things, money and sex. When I’m in front of groups I would say that I’m here to help you with one of those. But the reality is that if spouses aren’t talking about money, they certainly aren’t talking to their children about it.